Customer contact industry analyst firm ContactBabel (News - Alert) recently published the "U.S. Contact Center HR & Operational Benchmarking Report (2014)," its annual report studying the quantified performance and human resources aspects of U.S. contact center operations. It is based on a detailed survey of hundreds of U.S. contact centers. Here some of the s key findings from the research.

Agent Attrition

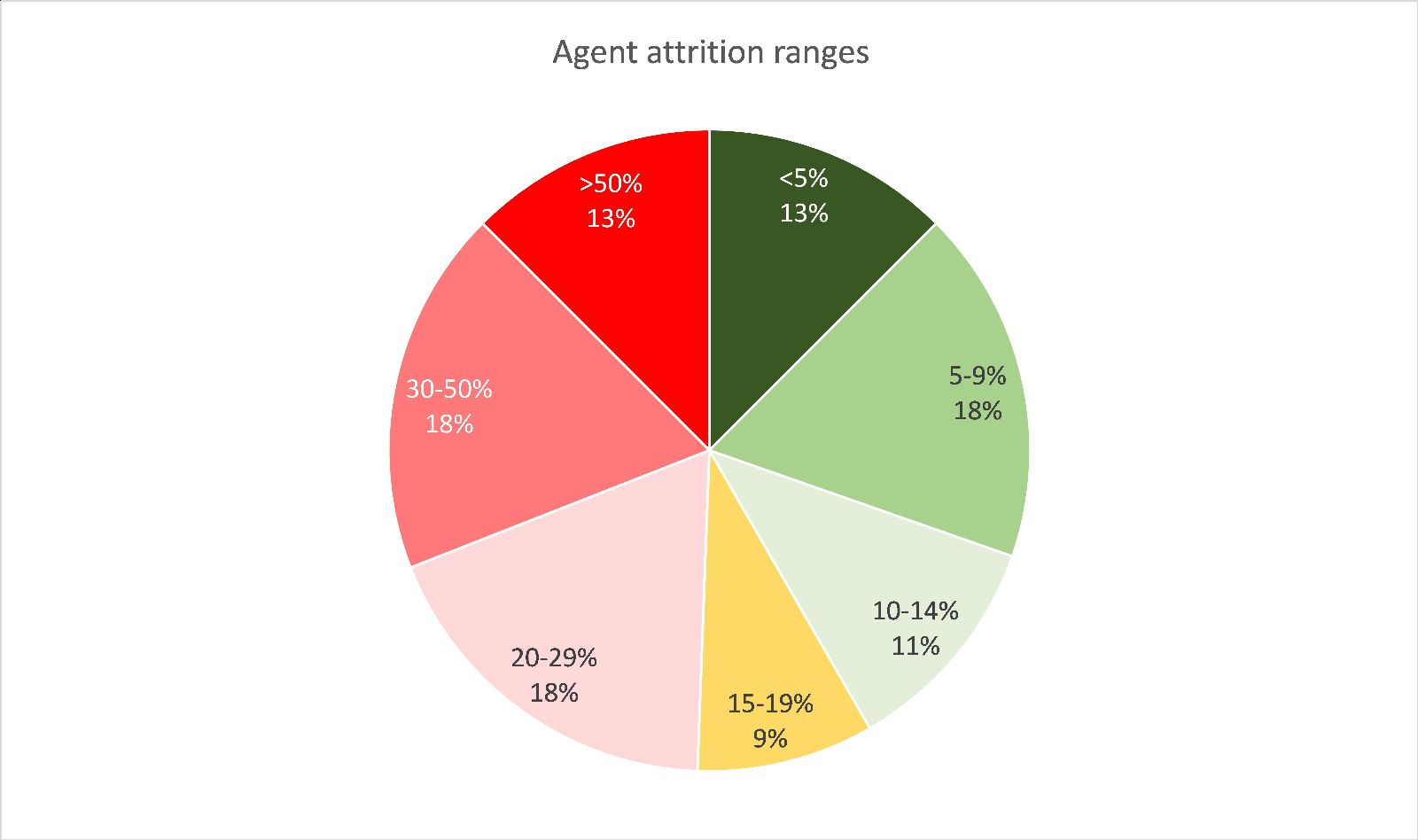

After 2008's very high mean attrition rate of 42 percent, rates declined significantly in 2009, down to a mean of 34 percent, showing that the economic downturn had taken some of the HR pressures off, with 2010 data showing attrition levels again dropping to a mean of 32 percent. In 2011, mean attrition continued to fall to 27 percent, where it has remained since.

This average masks a very wide spread of attrition rates. While 13 percent of respondents have attrition rates in excess of 50 percent per annum, the same proportion have an attrition rate below 5 percent.

The outsourcing sector has a consistently high attrition rate – driven mainly by low salaries and lots of outbound telemarketing work – and this year, it has a mean average of 56 percent, far higher than most other sectors. The public and medical sectors once again report sub-20 percent attrition rates, and manufacturing respondents have very low attrition rates as well this year.

Salaries

Thirteen percent of this year’s respondents reported agent salary increases over 5 percent p.a., and a further 44 percent saw more moderate gains. Forty percent saw little or no change, and only 3 percent reported a drop in salary levels.

|

Role |

2014 mean average salary |

|

New agent |

$27,542 |

|

Experienced agent |

$34,777 |

|

Team leader / supervisor |

$43,977 |

|

Contact center manager |

$67,580 |

New agents in the public sector get paid the most this year ($32,667), and outsourcing agents remain among the lowest-paid on average ($19,498), as they have been for some time, although this includes only basic salary, not the sales-related bonuses that may be more relevant to this sector.

At a management level, manufacturing and public sector contact center managers are paid the highest ($78,000 and $76,182, respectively). The respondents from the entertainment and leisure and outsourcing sectors do not pay particularly well this year ($62,143 and $55,070, respectively), although again these are likely to add a significant bonus figure based on sales, especially those in the latter vertical market.

Operational Performance

The report gives details of the performance of the contact center industry, as well as the actual and planned growth in headcount, and capex and opex budgetary elements.

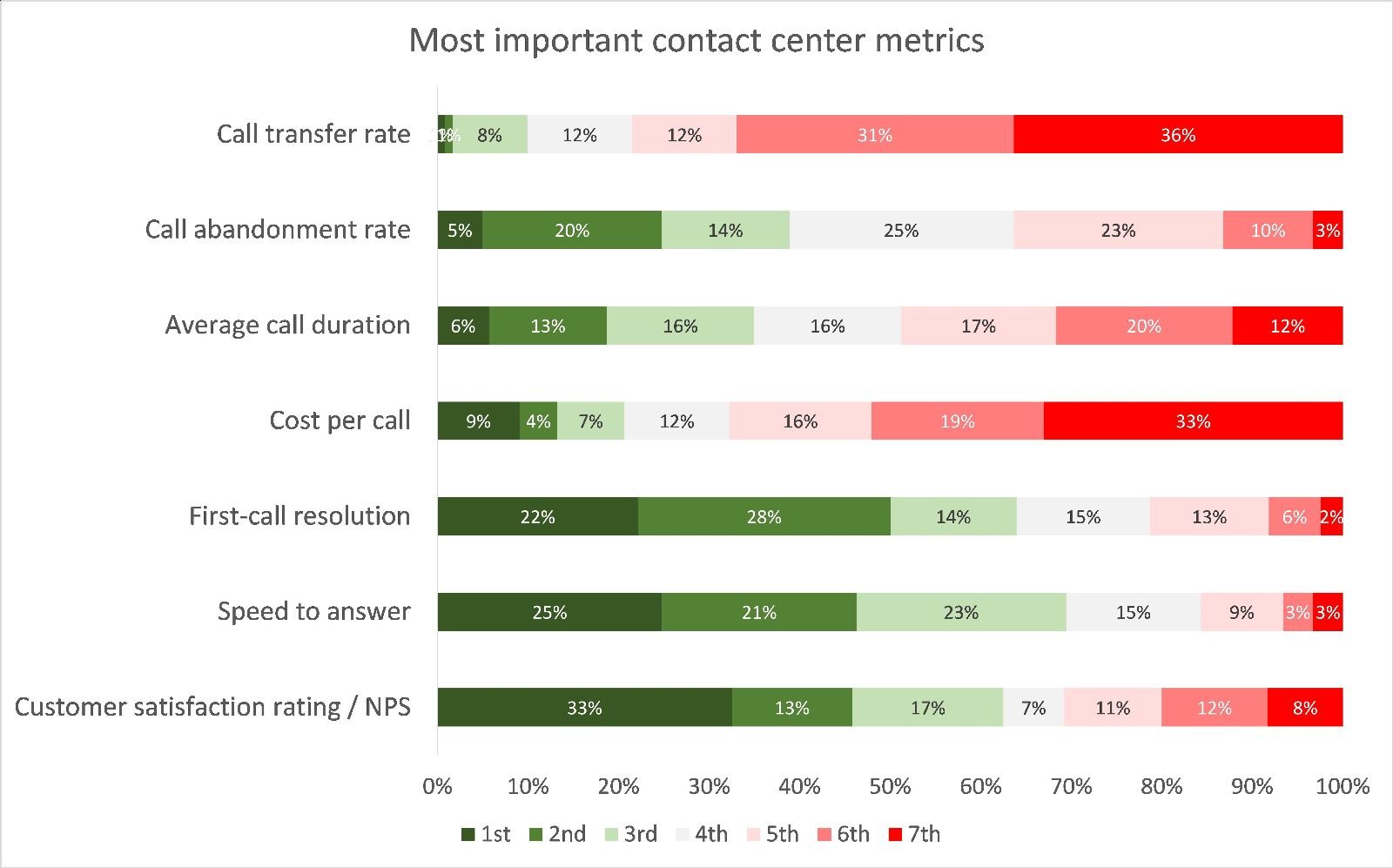

Over the years the importance of contact center metrics have changed considerably. Ten years ago, average call duration and cost-per-call were considered to be perhaps the most important metrics, but respondents to recent reports consider them of minor importance compared to more customer-focused measurements.

Unsurprisingly, one-third of respondents chose customer satisfaction rating as being the most important measurement that a contact center tracks. However, first call resolution and speed to answer are very close behind. Both of these metrics are of huge importance to customer satisfaction (or the lack of it), and handling more calls effectively the first time is key to improving customer satisfaction and reducing repeat calls, which will impact positively upon queue lengths.

First-Call Resolution

Mean average first call resolution increased to 74 percent from 71 percent this year, and the median moved up by two percentage points to 80 percent. The median is included as a few respondents have a very poor first-call resolution rate, which can drag the mean average down considerably. The first quartile (best 25 percent) FCR rate is 90 percent, with the third quartile at an FCR rate of 65 percent. Medical, retail, and services respondents report the highest levels of first call resolution, with technology/media/telecoms and manufacturing sectors the lowest.

Average Speed to Answer

While high-volume yet simple interactions, such as password reset and account balance, are carried out via self-service, whether through IVR or the website, the overall industry ASA mean average has stayed relatively steady since around 2005, at 25 to 30 seconds. This year’s jump to 43 seconds may be a result of a small number of respondents with very long speeds to answer being present in the research, as the median of 24 seconds is quite similar to previous years.

Selected Performance Metrics

|

Metric |

Mean average |

Median average |

|

Average speed to answer |

43.3 seconds |

24.0 seconds |

|

Call abandonment rate |

5.3% |

4.0% |

|

First-call resolution rate |

74% |

80% |

|

Call duration (service) |

381 seconds (6m 21s) |

310 seconds (5m 10s) |

|

Call duration (sales) |

408 seconds (6m 48s) |

325 seconds (5m 25s) |

|

Call transfer rate (excl. receptionists) |

8.5% |

4.8% |

|

Cost of inbound call |

$5.84 |

$4.50 |

|

Cost of outbound call |

$6.34 |

$4.53 |

|

NB: as a few respondents may show extreme results, data are not distributed symmetrically. Median values show the midpoint and may demonstrate the truer picture of a ‘typical’ operation. If calculating an industry-wide amount (e.g. total cost of calls, or total time spent waiting to answer), the mean average is more appropriate. |

||

Detailed, in-depth analysis of all of the above performance and HR metrics, including historical changes, future predictions, and segmentations by vertical market, contact center size and type of activity are available in the report.

Steve Morrell is principal analyst at ContactBabel (www.contactbabel.com).

Edited by Maurice Nagle